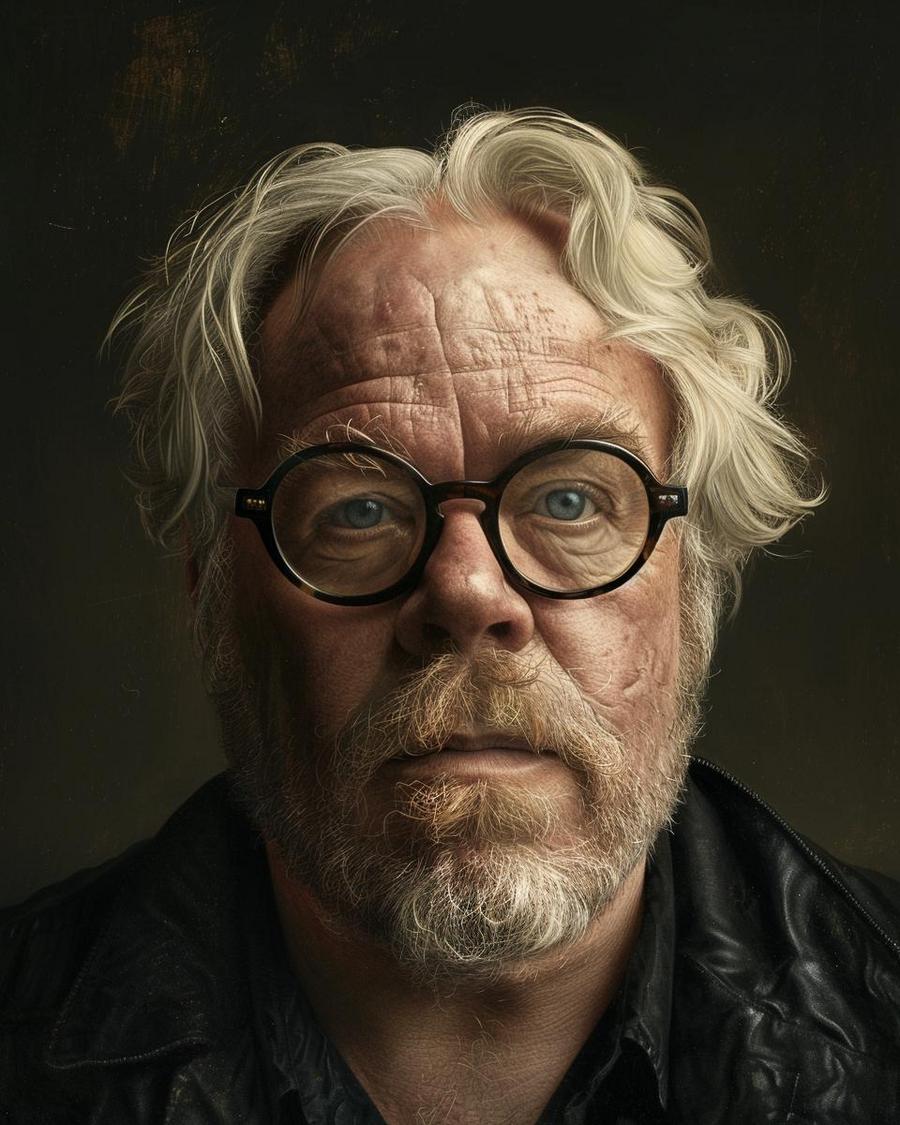

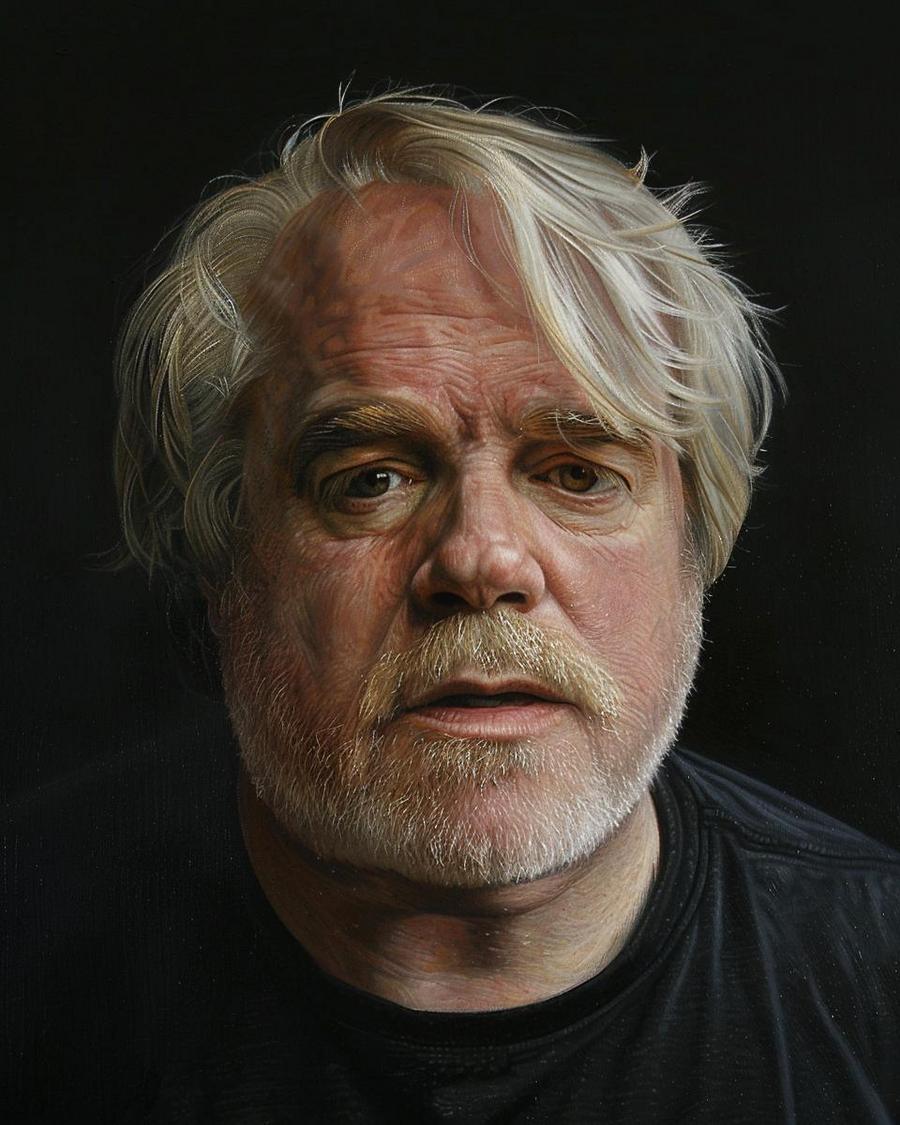

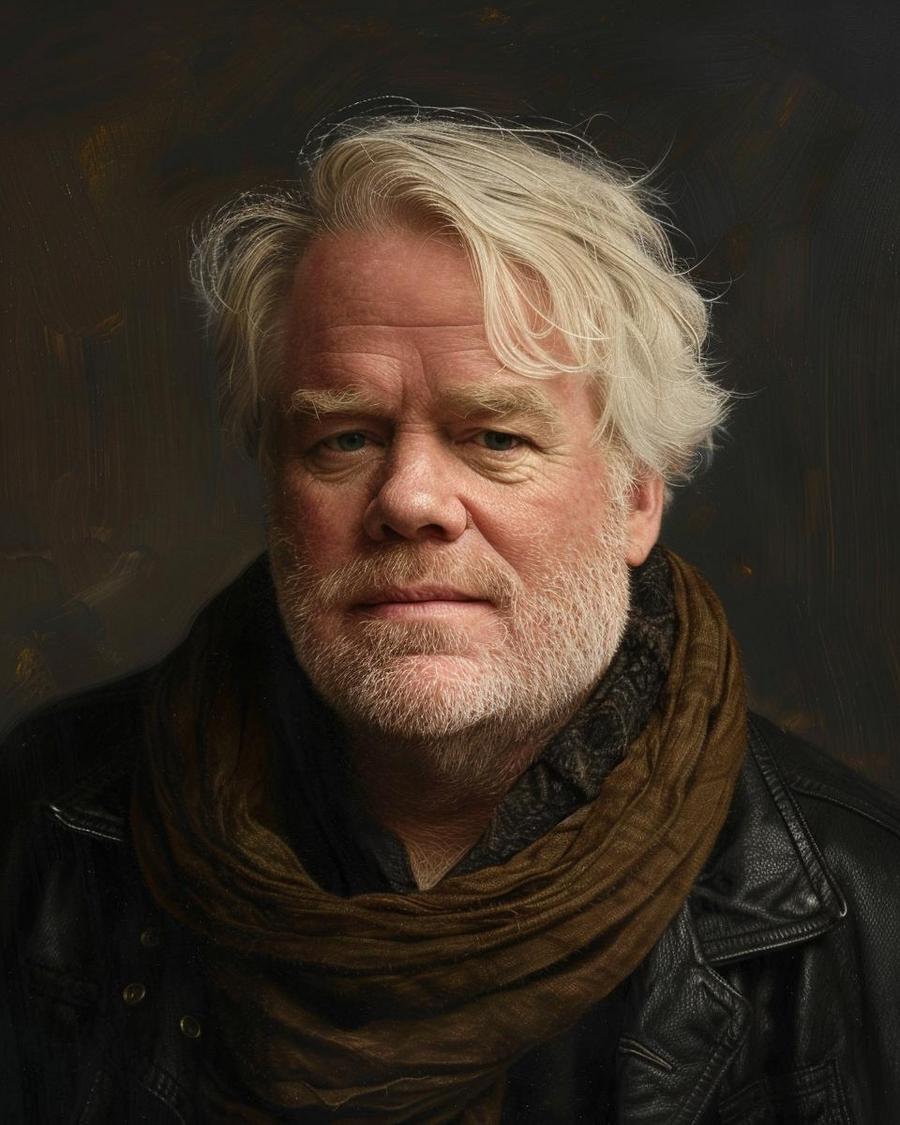

Philip Seymour Hoffman’s Net Worth Revealed

Have you ever wondered about the Philip Seymour Hoffman net worth at his untimely demise? This legendary actor left behind not just a legacy of unforgettable performances but also a complex financial estate. Today, we delve deep into the intricacies of his wealth, revealing insights that might surprise you.

- Estimated net worth of $35 million at death

- Controversial estate planning decisions

- Significant earnings from film and theater

Moreover, how did his financial decisions compare to his peers? For instance, explore the financial journey of Lewis Black or discover the earnings that shaped Joey Lauren Adams’ wealth. Each story offers unique insights into the world of celebrity finances.

Now, let’s uncover the layers of Hoffman’s financial choices. How did they impact his loved ones? What lessons can we learn from his planning strategies? Join us as we explore these questions, providing a clearer picture of his financial legacy.

What was Philip Seymour Hoffman’s Net Worth at the Time of His Death?

Philip Seymour Hoffman’s net worth was about $35 million when he died. He made his money from acting in films and theater. His estate included real estate and investments. His death had a big impact on his net worth. Wealthy Persons offers some insights on how his assets were managed and valued.

Hoffman was famous for playing unique and interesting roles. He won an Oscar and was loved by many for his work. His money came from acting, but he also had smart investments. This helped grow his wealth over the years.

When he passed away suddenly in 2014, it shocked the world. His death also affected his financial plans. His estate had to be handled carefully. He left all his money to his long-time partner, Mimi O’Donnell. This choice was to help his kids learn to make their own money.

How Did Philip Seymour Hoffman Accumulate His Wealth?

Philip Seymour Hoffman’s wealth came from his acting. He earned from both movies and theater. His career spanned over two decades, marking significant earnings.

He starred in top films like Capote and The Master. These roles increased his salary, helping him build a substantial financial base. Hoffman’s iconic roles often meant he negotiated higher pay for his unique skills.

He also made money from royalties. Films like Boogie Nights and Cold Mountain were hits. These movies ensured continuous earnings from royalties long after their initial release. You can read more about Hoffman’s financial decisions and estate planning.

Thus, through a mix of salaries and royalties from his diverse roles, Hoffman amassed his wealth, estimated at around $35 million at his death.

What Were the Key Financial Moves in Hoffman’s Career?

Philip Seymour Hoffman made smart choices in his acting roles. He picked projects that not only boosted his career but also his pocketbook. Hoffman’s keen eye for powerful scripts and directors placed him in high-paying, acclaimed movies. This strategy greatly enhanced his finances.

Beyond acting, Hoffman was wise in managing his assets. He invested in real estate and other valuable assets. These investments likely grew over time, increasing his net worth.

He also earned well from endorsements. Brands tied to the arts and quality found Hoffman a perfect partner. These deals added a significant chunk to his income. To learn more about how endorsements impact finances, check out this detailed insight on endorsements.

Thus, Hoffman’s financial success was not just luck. It was a mix of wise role selection, smart investments, and lucrative endorsements. Each choice played a key role in building his impressive net worth.

Who Inherited Philip Seymour Hoffman’s Estate?

After Philip Seymour Hoffman passed away, Mimi O’Donnell, his long-time partner, inherited his entire estate. This decision was detailed in Hoffman’s will. They were not married, but she was the mother of his three kids: Cooper, Tallulah, and Willa.

Hoffman aimed to keep his kids from relying on trust funds. He wanted them to find their own paths without the safety net of inherited wealth. This was a bold move, but it stirred up some legal issues. Since Hoffman and O’Donnell were not married, his estate faced heavy taxes. This could have been avoided.

The will did not mention his younger daughters because they were not born when it was written. This oversight led to complications and discussions about his final wishes. Despite these issues, Hoffman’s main goal was to secure his family’s future while encouraging independence and financial responsibility among his children.

What Lessons Can Be Learned from Hoffman’s Financial Planning?

Philip Seymour Hoffman’s approach to estate planning had significant tax implications due to some key mistakes. One major mistake was not marrying Mimi O’Donnell. This decision led to a huge tax hit on his estate, as marriage would have offered tax benefits. We can learn the importance of understanding tax laws in estate planning.

Another lesson is the value of professional financial advice. Hoffman’s planning lacked provisions for his two younger daughters. This oversight could have been avoided with expert advice. It shows us that professional guidance is crucial, especially for complex family situations.

Lastly, Hoffman aimed to keep his kids from relying solely on their inheritance. This intention, while noble, was not backed by a clear legal framework, which could lead to potential conflicts or challenges for the children. It teaches us the importance of detailed and clear legal planning in safeguarding our children’s future while instilling the right values.